YouTube

7YEARS OF EXPERIENCE

We Are a

IEPF Consultants

Agency

India's Largest & Most Trusted Platform For Unclaimed Investment & Debotor Recovery.

7YEARS OF EXPERIENCE

Are You Finding it

Difficult?

To Recover Money From Debtors

India's Largest & Most Trusted Platform For Unclaimed Investment & Debotor Recovery.

7YEARS OF EXPERIENCE

What We

Do ?

We Assist In Recovery Of Lost / Forgotten Or Scattered Investment

India's Largest & Most Trusted Platform For Unclaimed Investment & Debotor Recovery.

7YEARS OF EXPERIENCE

Have Your Shares Transferred To

IEPF

Govt .Of India ?

India's Largest & Most Trusted Platform For Unclaimed Investment & Debotor Recovery.

7YEARS OF EXPERIENCE

Not Claimed

PF Yet ?

We Will Assist You.

India's Largest & Most Trusted Platform For Unclaimed Investment & Debotor Recovery.

7YEARS OF EXPERIENCE

Lost Your Physical

Shares?

Will Get You Duplicate Shares.

India's Largest & Most Trusted Platform For Unclaimed Investment & Debotor Recovery.

7YEARS OF EXPERIENCE

Apply Welth Protect

Card

Protect Your Welth From Disaster.

India's Largest & Most Trusted Platform For Unclaimed Investment & Debotor Recovery.

7YEARS OF EXPERIENCE

Your Single-Window

Solution

To Unclaimed Investments.

India's Largest & Most Trusted Platform For Unclaimed Investment & Debotor Recovery.

7YEARS OF EXPERIENCE

Are You Finding It

Difficult

To Claim Dividend,Bonus ?

India's Largest & Most Trusted Platform For Unclaimed Investment & Debotor Recovery.

7YEARS OF EXPERIENCE

Are You Sitting

On

Loads Of Physical Shares ?

India's Largest & Most Trusted Platform For Unclaimed Investment & Debotor Recovery.

7YEARS OF EXPERIENCE

Are You Facing

Problems

With Share Succession Issue.

India's Largest & Most Trusted Platform For Unclaimed Investment & Debotor Recovery.

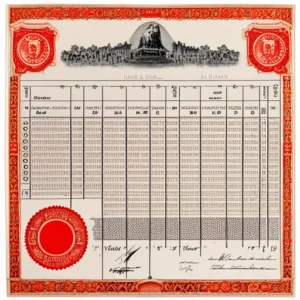

DEMAT OF PHYSICAL SHARES

Dematerialisation is when you turn paper shares into electronic shares. To do this, you need to open a demat account with a Depository Participant. Then, you give them your paper shares, and they give you electronic shares in your demat account. It’s a requirement for the main shareholders, but everyone else can decide whether they want paper or electronic shares.

Why do you need a demat?

If you want to buy or sell shares, you need a demat account. If you have physical shares, you can’t trade them. Having your shares in a demat account is safe and easy. You don’t have to worry about risks from physical shares or deal with lots of paperwork. You can quickly transfer shares and reduce the chances of mistakes. Dividends, bonuses, stock splits, rights, and other rewards will automatically go into your account, so you don’t lose them during transit. You don’t have to talk to lots of companies, because any updates will show up for all your shares.

How We Can Help You?

Shareholders might face problems, but we’re here to help you out. The easiest way to fix any issues is to switch from physical shares to demat shares. Some common problems that shareholders face include not using their demat account for a long time, or opening a new account without transferring shares from the old one. These problems can make it hard to trade, transfer, or get benefits like dividends. Sometimes, not updating your address can also cause issues. Lastly, losing your demat details can make it hard to talk to the company or the people who take care of your shares. We can help you with any problems you face.